st louis county personal property tax lookup

These tax bills are mailed to citizens in November and taxes are due by December 31st of each year. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Personal Property Declaration St Louis County Fill And Sign Printable Template Online Us Legal Forms

Louis Missouri State and at the Federal level.

. Account Number number 700280. To declare your personal property declare online by April 1st or download the printable formsIf you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing email protectedstlouis-mogovYour feedback was not sent. Louis County Auditor 218-726-2383 Ext2.

We have tried. Residents with no personal property tax assessed in the prior year can obtain a statement of non-assessment tax-waiver. Michael Dauphin Assessor 314 622-4050 Email full profile The Assessors Office.

Personal Property Tax Lookup And Print Receipt. Monday - Friday 800am - 500pm. Louis County Circuit Court 7900 Carondelet in Clayton Monday through Friday 800 am to 500 pm.

Mail payment and Property Tax Statement coupon to. The Personal Property Department collects taxes on all motorized vehicles boats recreational vehicles motorcycles and business property. Tax Forfeit Land Sales.

City Hall Room 109. Search Valuable Data On A Property. You may file a Small Claims case in the St.

Browse Discover Useful Results. Personal Property Tax Department. Search by Account Number or Address.

Personal Property Tax Department. Monday - Friday 8AM - 430PM. The City of St.

Property Tax Look Up. They are maintained by various government offices in St. To declare your personal property declare online by April 1st or download the printable forms.

Assessments are due March 1. Other departments may be able to help if you are looking for. Saint Louis County Home Saint Louis County Land Explorer Parcel Tax Lookup Contact Information.

Louis is pleased to present the information on this web site. On May 20 1809 Daniel Bissell took command of Fort Belle Fontaine the first military fort west of the Mississippi River. Start Your Homeowner Search Today.

Skip to search. Ad Get In-Depth Property Tax Data In Minutes. May 15th - 1st Half Real Estate and Personal Property Taxes are due.

Louis County Courthouse 100 N 5th Avenue West 214 Duluth MN 55802. Such As Deeds Liens Property Tax More. If you do not receive a form by mid-February please contact Personal Property at.

Account Number or Address. Tour Colonial History at the Daniel Bissel House. For information call 314-615-8091.

Declare your Personal Property. Louis County Auditor 218-726-2383 Ext2. They are a valuable tool for the real estate industry offering both buyers.

Louis County Assessors Office is responsible for accurately classifying and valuing all property in a uniform manner. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. The Assessors Office assesses and records information on all property for the City of St.

May 15th - 1st Half Agricultural Property Taxes are due. The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes. Real Estate and Property Information Taxes valuation assessment sales info land use Boundary Geography Maps neighborhood ward blocks zones districts.

Find Your County Online Property Taxes Info From 2021. You will be directed to the Parcel Tax Lookup screen. Use your account number and access code located on your assessment form and follow the prompts.

Louis County Courthouse 100 North 5th Avenue West Duluth MN 55802. November 15th - 2nd Half Agricultural Property Taxes are due. We look forward to serving you.

Address Property Search. Look up the tax statement you are paying on and click on the Pay Taxes button to continue making your payment via. City Hall Room 109.

Ad Search for St louis property tax records. For a pamphlet with information on Small Claims Court call 314-615-2601 or 314-615-2592. Monday - Friday 800am - 500pm.

The value of your personal property is assessed by the Assessors Office. 41 South Central Clayton MO 63105. Results from Multiple Engines in Fastquicksearch.

Monday - Friday 8 AM - 500 PM NW Crossings South County. Ad Find Information On Any Your County Property. Louis County Parks Cultural Sites Manager John Magurany talks about the rich colonial history youll find in.

November through December 31st you may also drop off your payment in the night deposit box at one of four Commerce Bank locations. November through December 31st you may also drop off your payment in the night deposit box at one of four Commerce Bank locations. Saint Louis County Home Saint Louis County Land Explorer Parcel Tax Lookup Contact Information.

What would you like to see. Louis County Auditor St. We are committed to treating every property owner fairly and to providing clear accurate and timely information.

Additional methods of paying property taxes can be found at. E-File Your 2022 Personal Property Assessment.

![]()

District 4 St Louis County Website

County Assessor St Louis County Website

County Assessor St Louis County Website

Property Details Search Property Details Search

Deed Search St Louis County Website

District 3 St Louis County Website

Print Tax Receipts St Louis County Website

Revenue St Louis County Website

Online Payments And Forms St Louis County Website

Your St Louis County Government St Louis County Website

Revenue St Louis County Website

County Assessor St Louis County Website

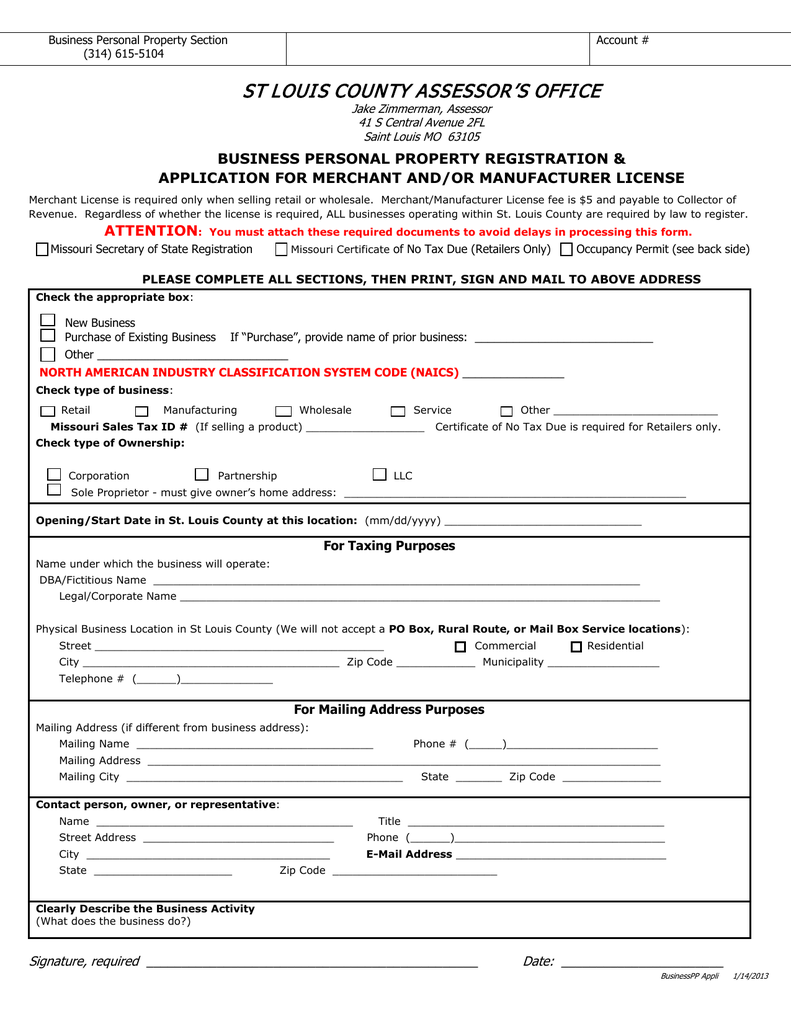

St Louis County Assessor S Office